Comparison of Islamic and Conventional Capital Market

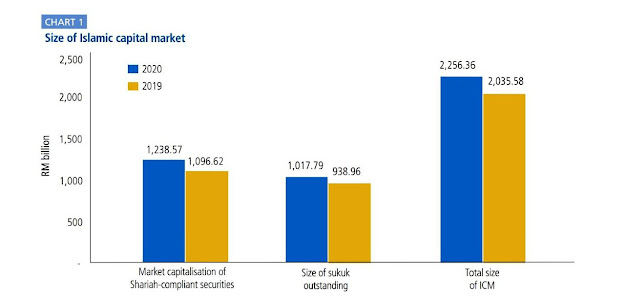

Chart 1: It

shows Malaysia’s Islamic capital market continues to garner a larger share of

the overall capital market. Its market size was RM2,256.36 billion in December

2020, up from RM2,035.58 billion at the end of 2019. With a difference of total

size is RM1,169.94 billion. This includes a total market capitalization of

RM1,238.57 billion in Shariah-compliant equities and a total outstanding sukuk

of RM1,017.79 billion.

.jpg)

Chart 2: Shariah-compliant stocks climbed

from 714 at the end of 2019 to 742 in December 2020, accounting for 79.27 % of

the 936 listed securities on Bursa Malaysia. Shariah-compliant securities had a

market value of RM1,238.57 billion, or 68.15 % of the overall market

capitalization, up 12.94 % from the end of 2019. With 219 securities (29.51 %),

the industrial products and services sector has the most Shariah-compliant

securities, followed by the consumer products sector with 150 securities (20.22

%), technology with 87 securities (11.73 %), and property with 82 securities

(11.05 %).

There are three main differences between

Islamic capital market and Conventional capital market:

1) Shariah Framework

Generally, Islamic capital market products are designed based on Shari'a law. Shari'a scholars ensure the proper implementation of Islamic law and provide direction for Muslims. Without Shari'ah compliance, Islamic finance markets will not be able to function. This droves many international organizations such as AAOIFI and IFSB to issue Shari'ah governance principles. Countries like Malaysia, which support the development of Islamic finance, have moved to develop their Shari'ah governance models and put them into practice. Bank Negara Malaysia has taken the lead in establishing a Shari'ah governance system.

At the national level, the Shari'ah Advisory Council (SAC) has the most authority, and each Islamic financial institution is supposed to have its own Shari'ah advisory board.

In other countries, such as Indonesia, it was formed by the Indonesian Council of Ulamas. Pakistan has its own SAC at the State Bank; in Kuwait, any conflict in Shari'ah issues could be referred to the "Fatwa Board" under the Ministry of Awqaf and Islamic Affairs. The United Arab Emirates has its Shari'ah board at the institution level, supervised by the SAC at the central. Thus, it may be stated that these countries have a Shari'ah governing framework but with various approaches to it.

Meanwhile, the conventional capital market is based on the same legal framework in all the countries. Unlike the Islamic capital market, it is not governed by religious regulations or standards. It is the function of the capital market to aid an economy by providing a platform for obtaining capital to fund business operations and development activities and wealth enhancement without following Shariah guidelines.

However, a few natures of conventional capital market contradict the Shariah principle, such as interest from loans or bonds provided by banks to issuers. Charged interest refers to riba, usury, or the charging of unreasonably high-interest rates. There are no restrictions in Conventional Capital Market. Making riba illegal is meant to ensure that people can protect their wealth by making unjust and unequal exchanges illegal. Islam aims to promote charity and help others through kindness. Removing sentiments of selfishness and self-centeredness can create social antipathy, distrust, resentment, and encouragement to act charitably by loaning money without interest.

One of the main issues of prohibiting interest is that interest rates regulate demand in modern finance. A particular interest rate is equivalent to a price for a specific investment. With no interest, credit becomes impossible to handle under traditional capitalist models. The Islamic capital market has argued for the use of a profit rate rather than an interest rate. This can evaluate the quality and return of specific investments and entrepreneurial activities. This concept also lends itself to interacting with countries that do not use an interest-free system and, in turn, being able to maintain the shariah principle.

2) Prohibited transaction

As mentioned before, the Islamic capital market prohibited riba or usury for use in trading. Other elements are forbidden in Islam based on hadith and the Quran. Islamic such as the stocks of companies dealing in unlawful activities such as gambling (maiysir), pork, alcohol, tobacco, pornography, trading with non-deliverance of goods or service, trading of risk that contain uncertainty (gharar), and others.

However, there are a few conditions that have been approved by the Shariah, including as a company's core activities must be halal, and its haram elements must be small in comparison to its core activities. The public opinion or image of the companies must be positive, and the core activities of the enterprises must serve the Muslim ummah (nation) and the country (common plight and difficult to avoid) to ascertain the state of the companies in which the funds intend to invest. The necessity to assess companies before investing in them derives from the Shari'ah principle that Muslims should not engage in activities that contradict Islamic principles. Various screening methodology developed and approved by the renowned Islamic scholars are used by financial institutions around the world. This is because Islam is very concerned about the welfare of society and protects it from dangerous things and oppression.

In the opposite, conventional capital market, the activities are accepted except for money laundering and the financing of criminal activities. For example, Heineken Malaysia Berhad is recognized as a producer of beer, stout, cider, and non-alcoholic malt beverages in Malaysia and is listed on the Main Board of Bursa Malaysia. The company can issue bonds in the conventional capital market, such as AmBank (M) Berhad, AMMB Holdings Berhad, Petronas Capital Limited, etc. This is because the company is a major in producing liquor and the top products are Amstel, Desperados, Sol, Tiger, and Birra Moretti, which are sold to non-muslims. One of the shariah-compliant listed in Bursa Malaysia is Aeon Co. (M) Sdn below consumer products and services. It has a segment that sells alcohol where there is a particular space to promote alcohol to non-Muslims.

3) Sukuk-Bond market

Although Sukuk is commonly referred to as "Islamic bonds," the correct translation of the Arabic phrase is "Islamic Investment Certificates." The AAOIFI published a sukuk investment that will allow Islamic financial products to enter the market. Since then, the sukuk sector has mobilized all Islamic investors' short and long-term savings and idle funds, as well as supplying cash and liquidity to capital demanders including businesses and governments. In contrast, conventional bonds are long-term debt instruments issued by corporations and governments that use coupon (interest), a fixed sum of money that the bond issuer is required to pay to bondholders on a regular basis (annually and/or semi-annually) until the bond matures. The majority of today's Sukuk are very similar to conventional bonds, however they differ in terms of their definition. The following table compares the instruments in detail:

.jpg)

.gif)

Comments

Post a Comment